Joining the Legacy of Hope Society

You can join the Legacy of Hope Society by making a planned gift to Guadalupe Center. What is a planned gift? It’s a contribution that a donor promises to make through their estate plan. It’s a legacy of hope – a way to be there for the charities that need your support beyond your lifetime. Also, it could have a positive impact on the other beneficiaries of your estate, resulting in significant tax savings. And finally, it provides flexibility – you can change your mind should your personal or financial situation change.

Types of Planned Gifts:

- Appreciated Stock

- Charitable Rollover

- Charitable Remainder Trust

- Endowments

- Beneficiary Designation

- Charitable Lead Trust

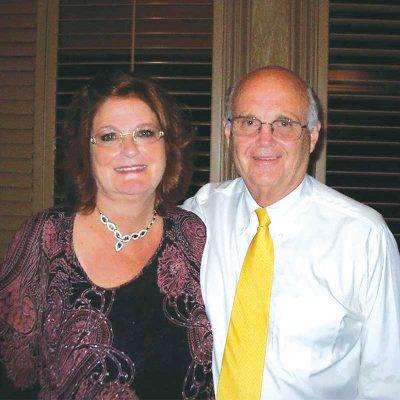

“We wanted to support Guadalupe Center over many years, but we wanted to do it in an intelligent way in terms of potential tax savings, and perhaps having some funds left over.”

– Debi and George Braendle, who established a Charitable Lead Trust (CLT) to support the building maintenance fund.

Choose Your Legacy

There are many types of planned gifts, any of which might inspire your giving. By choosing a planned gift for Guadalupe Center, you will become recognized as a member of the Legacy of Hope Society.

To learn more or become a member of the Legacy of Hope Society:

To learn more, contact Kelly Krupp, Vice President of Philanthropy at 239.657.7126 or KKrupp@GuadalupeCenter.org.

We recommend consulting your attorney or advisor when considering a planned gift. For a list of local professional advisors who work with Guadalupe Center to assist clients interested in making planned gifts, call 239.657.7711.

Designate Guadalupe Center as a Beneficiary

One way of planned giving is to list Guadalupe Center as a beneficiary in your will, trust, life insurance policy or retirement plan. A possible advantage is reducing the size of your taxable estate and minimizing taxes before assets are transferred to your heirs.

BEQUEST LANGUAGE:

“I do hereby give, devise and bequeath to…XX%

or $XX, of my estate to support for general use

and purpose.”

LEGAL NAME:

Guadalupe Center, Inc., a not-for-profit organization

ADDRESS:

509 Hope Circle, Immokalee, Florida 34142

FEDERAL TAX ID#:

59-2617151

Additional Planned Giving Options

Charitable Lead Trust

Establish an irrevocable trust that provides an income stream for a fixed number of years to Guadalupe Center. At the end of the term, the assets will pass to the donor’s family members or other beneficiaries. The donor receives a charitable deduction for a portion of the gift to the trust, and there could be substantial tax benefits.

Charitable Remainder Trust

Make a gift by transferring appreciated assets into an irrevocable trust. Get an immediate income tax deduction, maintain control of the investment of the assets, and receive income from the investment for the rest of your life, with the remainder of assets designated to Guadalupe Center at the end of the trust term. A Charitable Remainder Trust may help reduce the size of your taxable estate.

Establishing an Endowment Fund

Establish an endowment fund to benefit Guadalupe Center. Your endowment can fund a particular program or position, or help with general operating needs. You can contribute directly to one of the existing endowment funds, or with a minimum contribution, establish a new named endowment.

Establishing a Charitable Gift Annuity

Charitable Gift Annuities (CGAs) allow a donor to make a charitable contribution and receive a guaranteed lifetime income stream. While Guadalupe Center does not administer CGAs, many Community Foundations allow donors to establish a CGA and name Guadalupe Center as a gift recipient. At the end of the donor’s life, Guadalupe Center could be the beneficiary of the remaining balance, or receive the annual annuity payments, depending on the policy of the Community Foundation.

Appreciated Stock

Transferring stocks that have increased in value can provide greater tax advantages than cash. The market value of securities is deductible (subject to applicable limitations), and the donor avoids paying capital gains tax on the appreciation.

Charitable Rollover

Protecting Americans from Tax Hikes Act (PATH) allows IRA owners age 70½ and older to make a “Qualified Charitable Distribution,” which is excluded from income tax (up to $100,000 per taxpayer per year) to a qualified charity, such as Guadalupe Center. This action allows owners to convert otherwise taxable “Required Minimum Distributions” into non-taxable “Qualified Charitable Distributions.” This distribution means no increased taxable income or payment of additional tax.

To learn more, contact Kelly Krupp, Vice President of Philanthropy at 239.657.7126 or KKrupp@GuadalupeCenter.org.